The ironSource marketing company will be listed on the stock exchange through SPAC at a valuation of over $11 billion

The Israeli company ironSource has announced that it will go public and enter the stock exchange through a merger with SPAC. The valuation of the marketing platform exceeded $11 billion.ironSource will merge with the Special Purpose Acquisition Company (SPAC) Thoma Bravo Advantage.

Together they want to create a leading platform for the mobile app economy, VentureBeat reports.

The company’s valuation before the merger with SPAC was $11.1 billion. According to Bloomberg, under the terms of the deal, ironSource shareholders will receive $10 billion, including $1.5 billion in cash. The merger will be completed in the second quarter of 2021, as a result of which the company will have about $740 million in cash.

Usually, SPAC is considered a faster and easier way to enter the stock exchange for actively developing startups. However, ironSource differs from many companies that have recently become public using this method, since it is not unprofitable and already makes a profit.

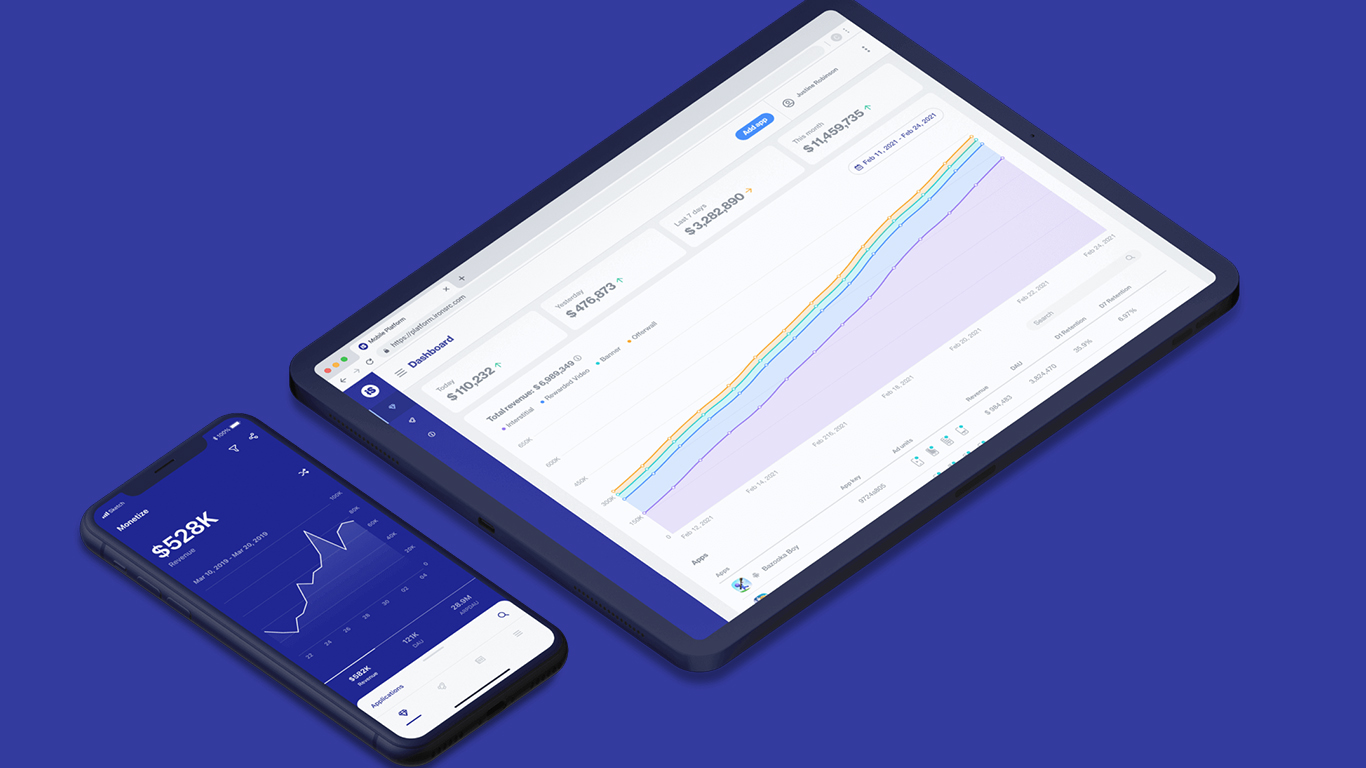

ironSource’s revenue for 2020 was $332 million (an increase of 83% year-on-year), and its EBITDA was $104 million. The company claims that the monthly audience of its services exceeds 2.3 billion users. Its platform provides developers with tools for monetization, user engagement and analytics of their applications.

ironSource has become the second major Israeli company to go public recently. Last December, Playtika raised $1.9 billion through an IPO at a valuation of $11.4 billion.