Drake Star Partners: since the beginning of the year, gaming companies have concluded 844 deals worth a record $71 billion

The gaming industry continues to boom deals. Investment banking company Drake Star Partners estimated that $71 billion was spent on investments, public offerings and M&A agreements in the first nine months of 2021. This is 2.1 times more than in the whole of last year.

The main thing from the report:

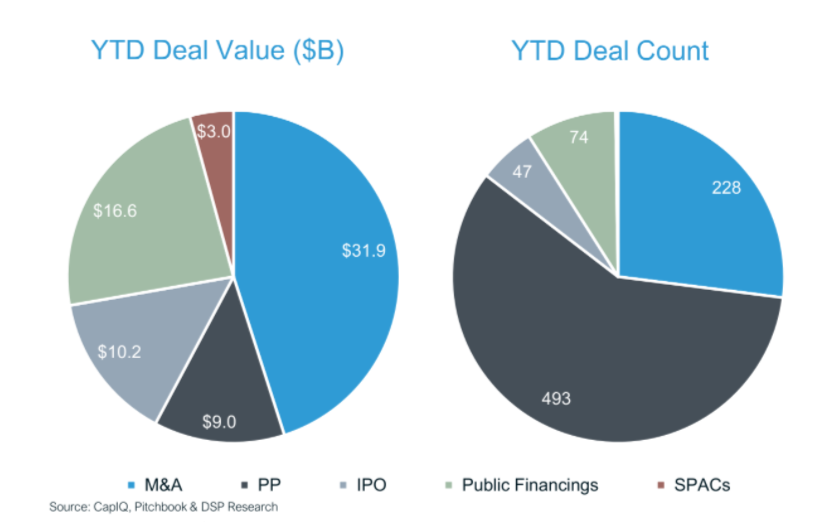

- A total of 844 game deals were announced or closed from January to September. Their total volume was $71 billion. For comparison, for the full year 2020, only 664 transactions worth $33.6 billion were conducted on the market;

- about half of the money came from M&A — $31.9 billion. There were 228 such deals in the first nine months of 2021;

- private investments turned out to be the most common type of transactions. 493 transactions worth $9 billion were conducted in this format;

- public companies have attracted 74 investments worth $16.6 billion. It is worth noting that they received almost all the funds before July. In July-September, gaming companies managed to attract only $0.2 billion;

- As for going public, 47 companies conducted IPOs with a total revenue of $10.2 billion. Also, some companies have become public through mergers with SPAC firms – they have earned $3 billion on this;

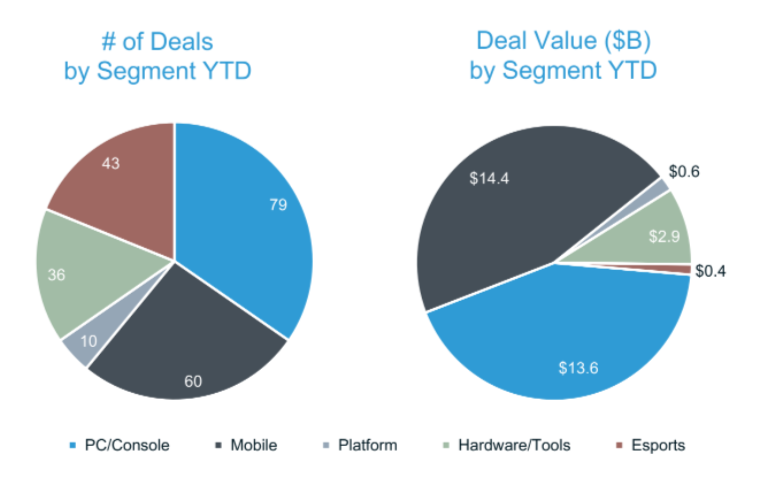

- The majority of M&A transactions in the period from January to September related to the PC and console segment – 79 transactions ($13.6 billion). The second most popular was mobile — 60 deals ($14.4 billion). Also, 43 transactions worth $0.4 billion were related to esports;

- The largest M&A agreement in nine months remains the purchase of ZeniMax Media by Microsoft for $7.5 billion. This deal closed in early spring. But if you look only at the third quarter (July-September), the takeover of SpinX Games by the South Korean publisher Netmarble for $2.19 billion comes out on top;

- the top 5 private investments included two investments related to NFT at once. Both took place on September 21. We are talking about the companies Sorare (raised $ 680 million) and Dapper Labs (raised $ 250 million). In just nine months, the developers of NFT games received $ 1.8 billion;

- Jam City ($350 million), Voodoo ($315 million) and Tilting Point ($235 million) were also in the top five in terms of the amount of private investments received.