DDM: the amount of investments in gaming companies in the first three quarters reached a record $9.9 billion

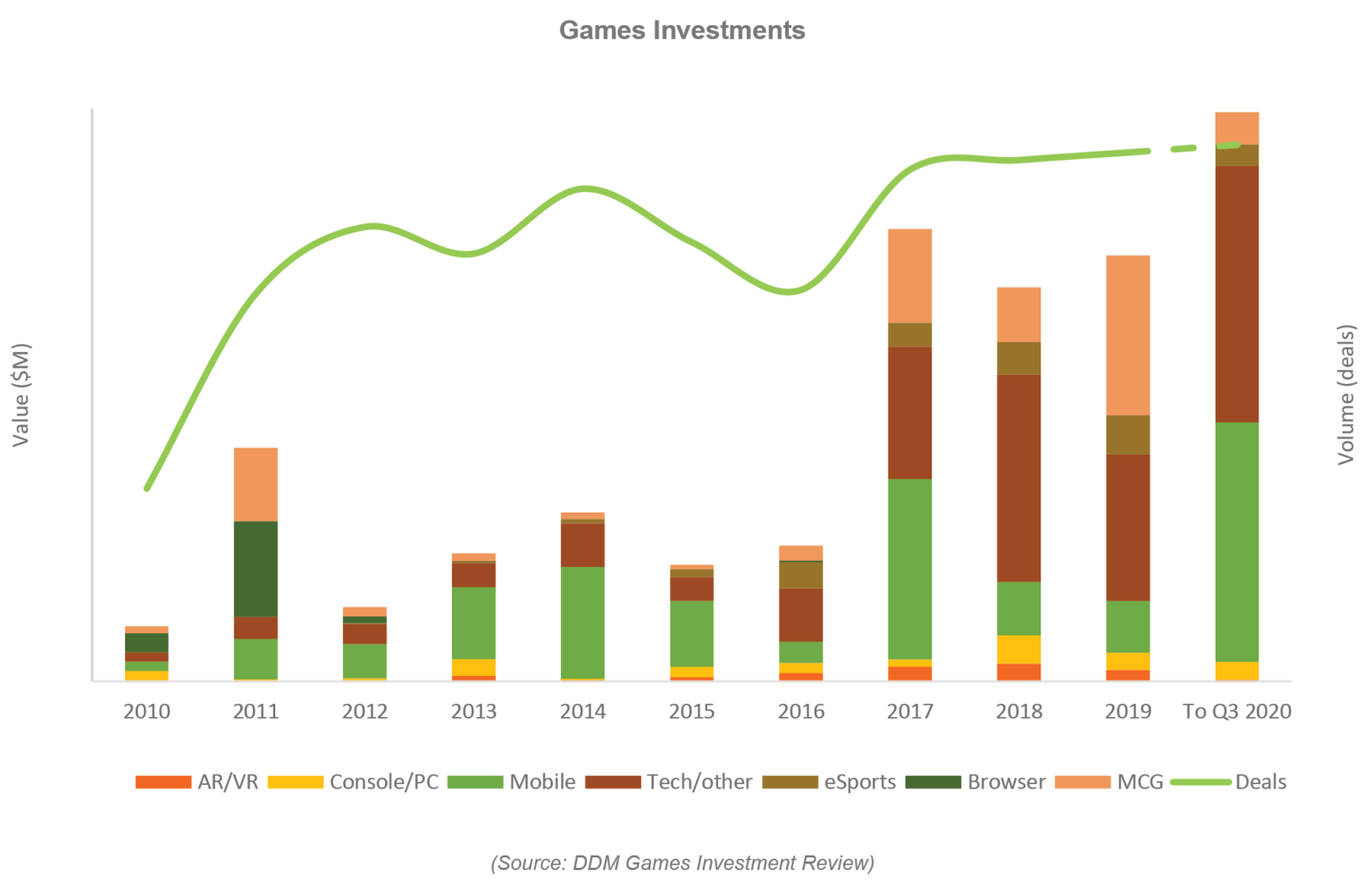

2020 was a record year for gaming investments. The total volume of investments for the first three quarters amounted to $9.9 billion. At the same time, more than half of this amount fell on the last three months.This is reported by Digital Development Management in its review of the investment market for the third quarter of 2020.

Her work is divided into two parts. The first is devoted to investments, the second to M&A transactions.

Key investment datain the third quarter of 2020, 110 investments worth $5.2 billion were made.

- This is more than all investments for the first half of the year combined;the most active investments were made in the categories of “Esports” and “Mobile”;

- Epic Games attracted the largest amount of investments — $1.8 billion.

- The company’s valuation now stands at $17.3 billion.Schedule of investments in gaming companies (from 2010 to the third quarter of 2020)

IPOs were the main driver of gaming investments in the third quarter.

- During this period, four companies entered the stock exchange, and the total amount of money raised amounted to $2.1 billion;The most successful of the IPO companies was Unity, which raised $1.3 billion.

- Corsair, Kakao Games and Archosaur Games/Zulong Entertainment also entered the exchange;The most active investors were Andreessen Horowitz, BITKRAFT Ventures and Play Ventures.

- Each of the funds invested in four companies.Top 10 investments for the third quarter of 2020

Main deals

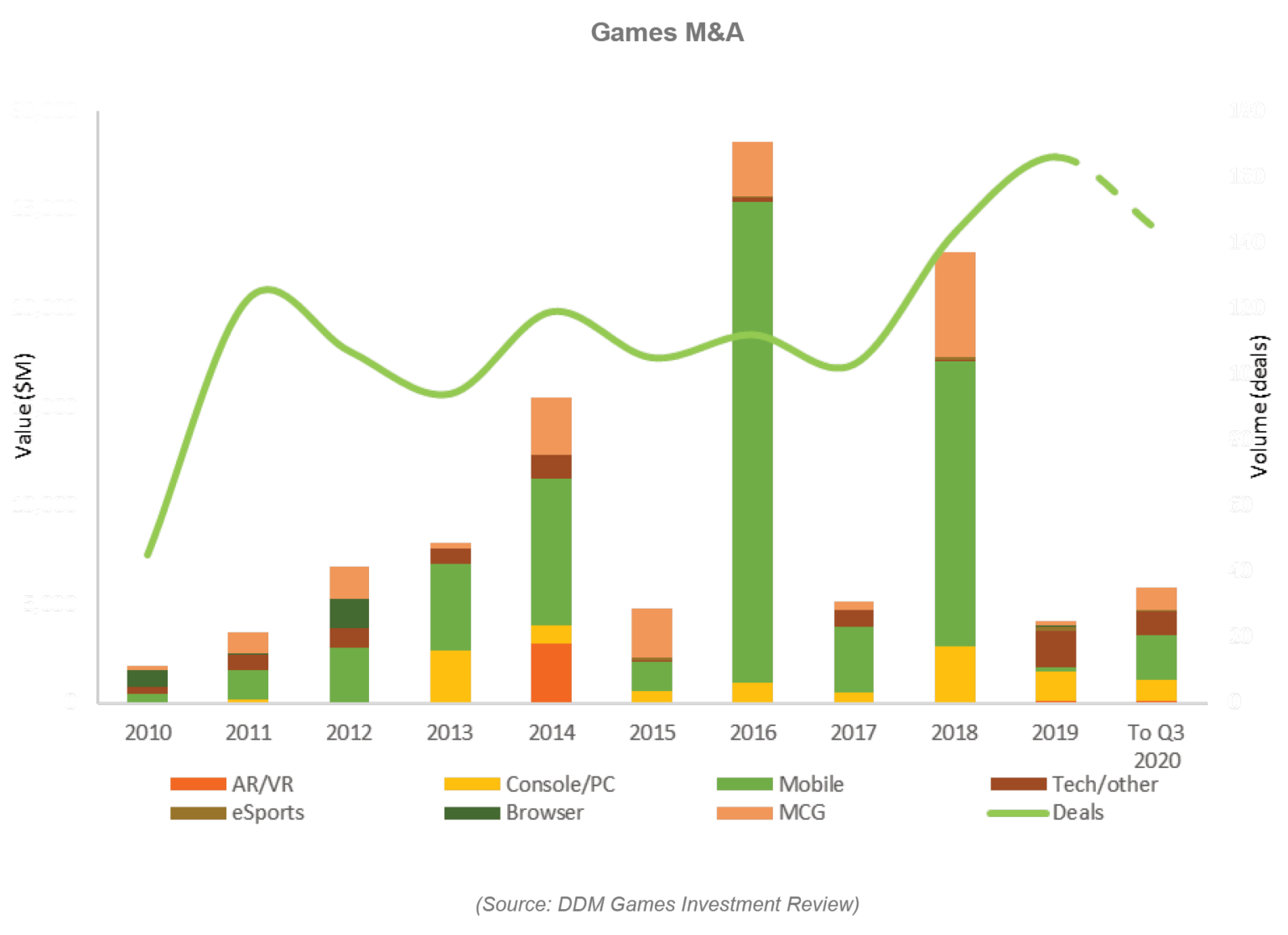

DDM counted 54 M&A deals in the third quarter.

- Their total amount was $3.5 billion (twice as much as in the last quarter);as in the case of investments, most transactions were made in the categories of “Esports” and “Mobile”;

- the largest deal was the purchase of Peak Games by Zynga for $1.85 billion;

- in second place is Tencent, which bought shares of the streaming platform Huya for $810 million and brought its stake in the company to 51%;

- Embracer Group became the most active company.

- In the third quarter, the Swedish holding absorbed eight studios and raised $648 million to buy new companies.Schedule of completed transactions (from 2010 to the third quarter of 2020)

DDM predicts that next year will also be a record year for the gaming industry.

The biggest role in this will be played by the purchase of ZeniMax for $ 7.5 billion (the deal will be closed in 2021) and the IPO of companies such as Roblox, Skillz and Playtika.

By the way, the last record was set in 2017 – then the annual amount of gaming investments amounted to $ 8 billion.

Also on the topic:

- Scopely has attracted $340 million in investments. This is almost twice as much as plannedThe former president of Rockstar North raised $42 million to develop a “competitor” GTA

- Instant gaming startup Playco raised $100 million at a valuation of $1 billion

- Is there any news?

Share it with us, write to press@app2top.ru