Lifespan of existing games increased by 33% in 2022, and other findings from Unity Gaming Report

Unity has released its annual report on the state of the games industry. Here are the key trends and insights regarding indie developers and larger studios using the engine and its tools.

Note: Unity collected data for the 2023 Gaming Report from more than 230,000 devs using its real-time development platform. More information was collected on ads data spanning over 423,000 devs on multiple platforms. An additional survey of 356 game developers was also conducted with a margin of error of +/- 5.2%.

Indie devs are shipping games faster

- The production cycle has been significantly reduced. According to the report, 62% of indie teams (1-9 people) and 58% of midsize studios (10-49 people) are now making their games in less than a year, from start to ship date.

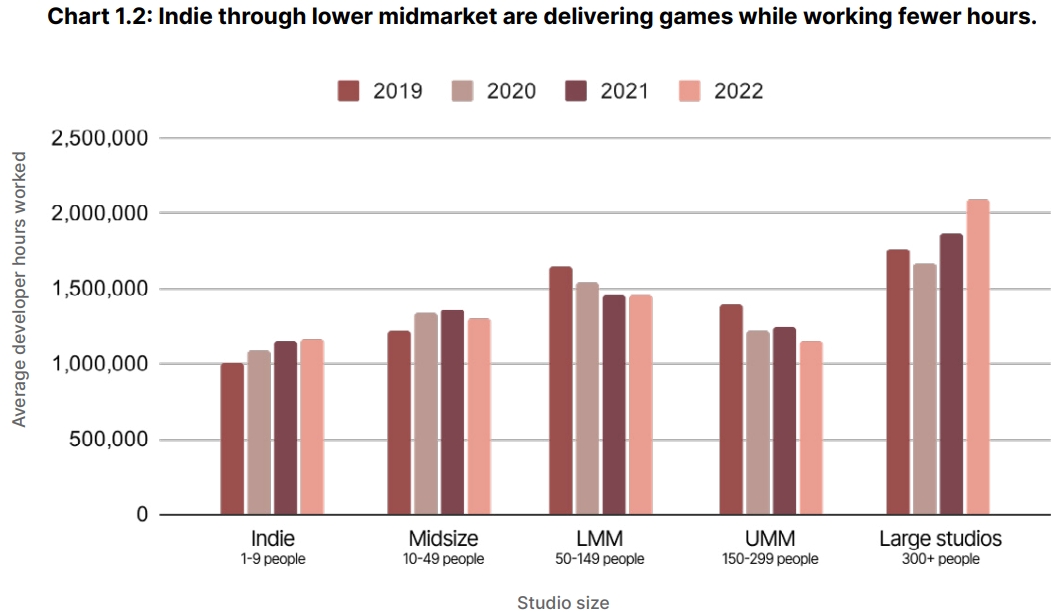

- It is worth noting that employees at indie, midsize, and lower midmarket companies are working 1.2% fewer hours. Unity notes that this “works out to about five years of total work hours, which helps make shipping a new title more attainable for many studios.”

- For 46% of indie developers, the prototyping phase lasts less than a month. This is partly due to the fact that 62% of indie teams use between five and 14 third-party asset packages for prototyping and concepting.

- According to Unity, developers who use premade assets from the Unity Asset Store shop games 20% faster.

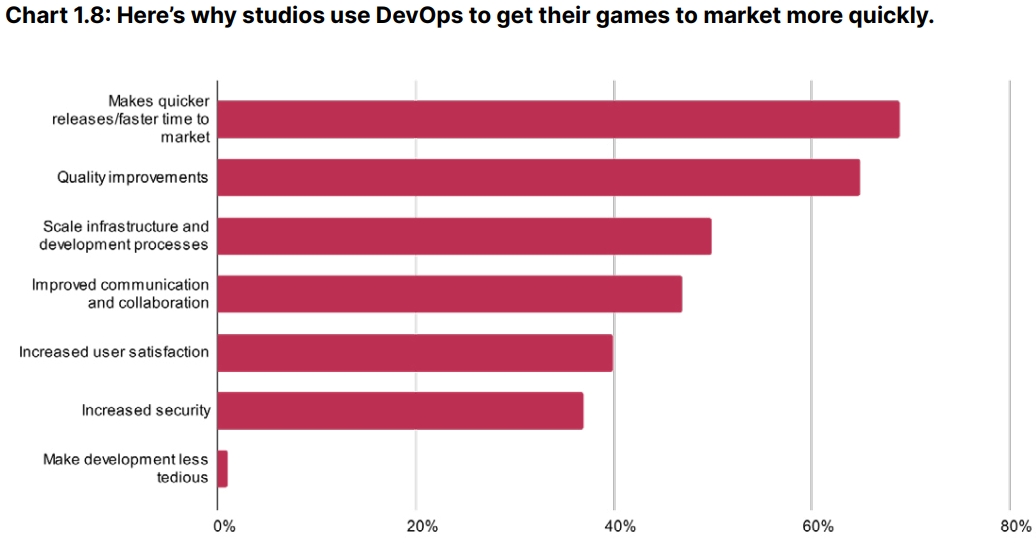

- 69% of studios use DevOps tools to make quicker releases, improve quality, increase security, and scale infrastructure.

Most preferred genres and platforms

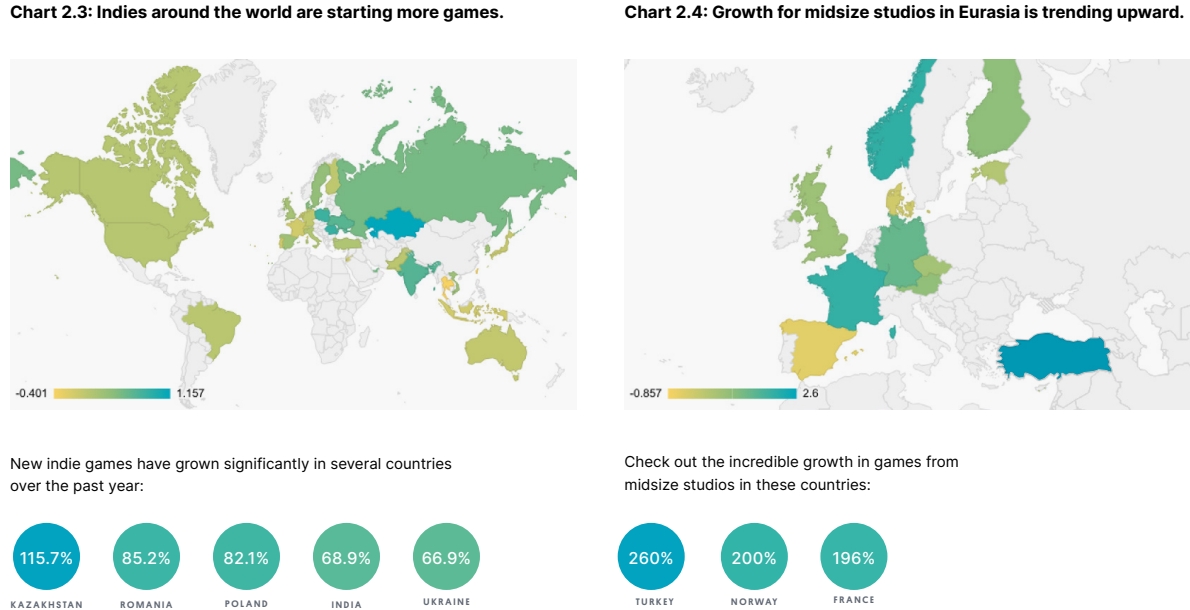

- In 2022, Kazakhstan saw the biggest increase in the number of new indie games at 115.7%. It is followed by Romania (85.2%), Poland (82.1%), India (68.9%), and Ukraine (66.9%).

- When it comes to midsize studios, the biggest spike happened in Turkey — 260%, followed by Norway (200%) and France (196%).

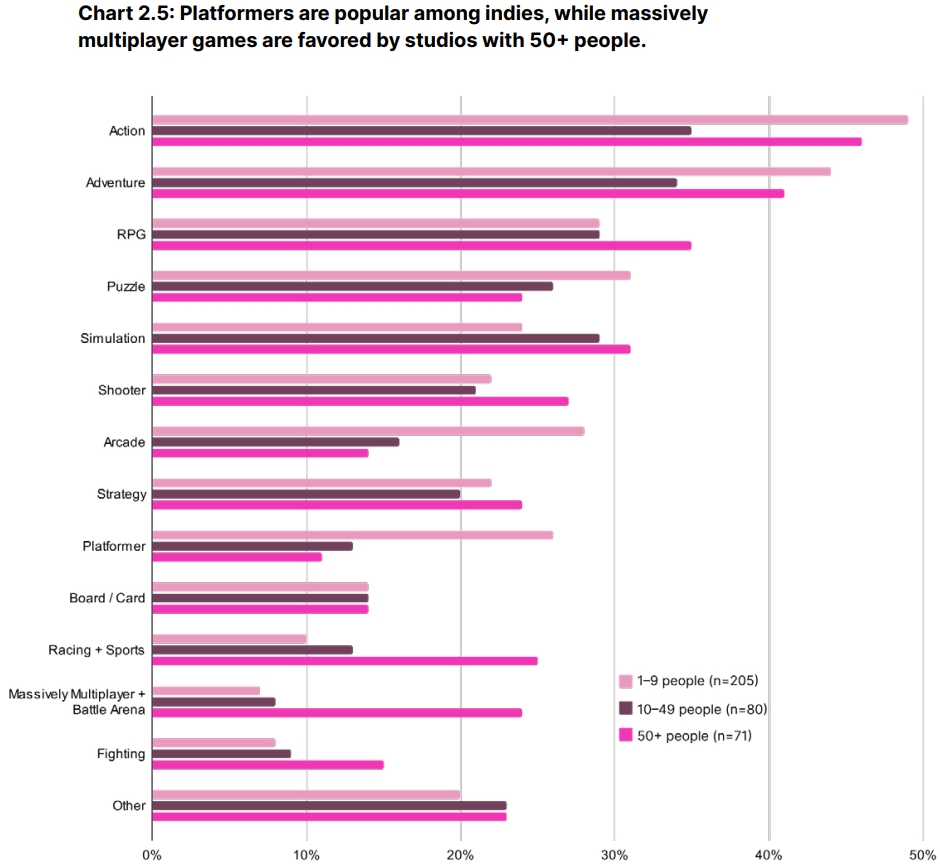

- Action is the most popular genre among indie teams, followed by Adventure and Puzzle. Small developers also tend to make more Platform and Arcade titles.

- Larger studios (50+ people) make more MMO and Racing games, as well as Shooters and RPGs.

- Last year, large studios released 16% more multiplatform games than in 2021, and 110% more than in 2019. 88% of studios with more than 50 employees are now making cross-platform games.

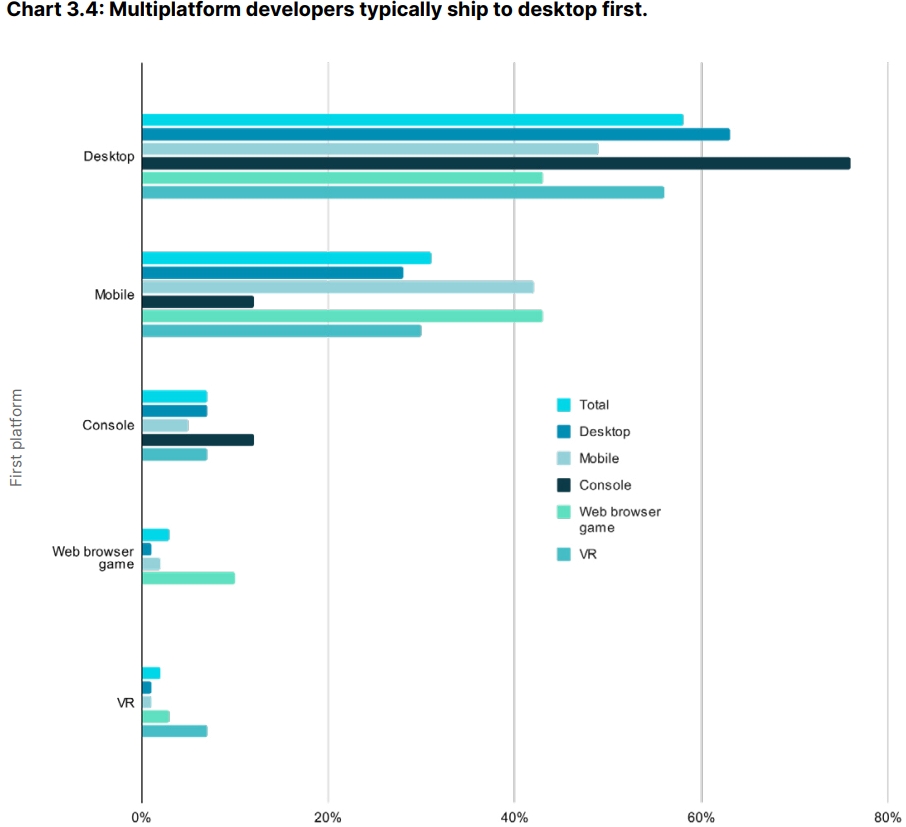

- Companies that choose consoles as their first platform are more likely to also bring their games to PC and VR.

- But overall, PC remains the top choice for all developers, with 76% of multiplatform studios preferring to start with desktop.

- 90% of small studios release their games on a single platform because they usually don’t have enough resources to ship to multiple platforms.

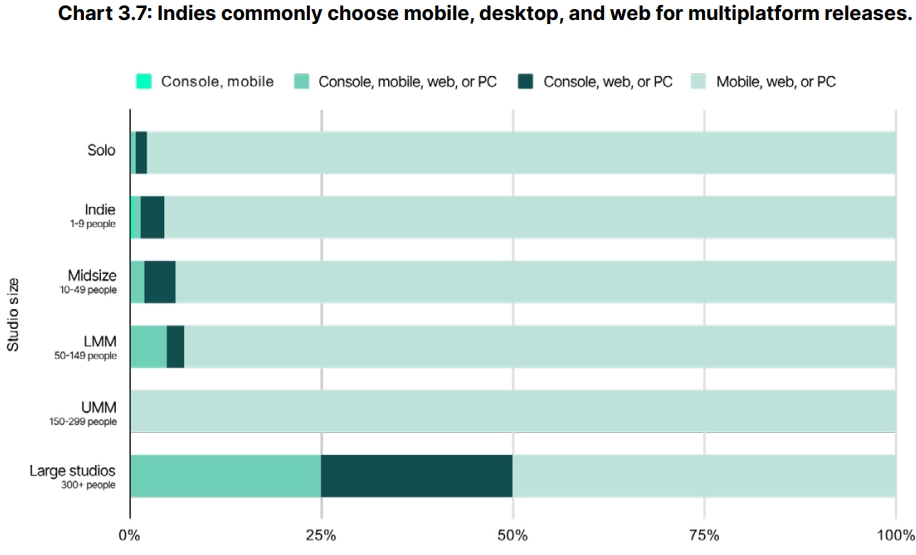

- Desktop is the top choice for 77% of indie developers. When they choose to ship to multiple platform, they prefer PC, mobile, or web.

- Large studios, on the other hand, also choose console/web/PC or console/mobile/web/PC options.

State of mobile game development

- In 2022, developers started making more mobile-only games compared to 2021. Large studios (300+ people) saw the biggest year-over-year increase at 44%.

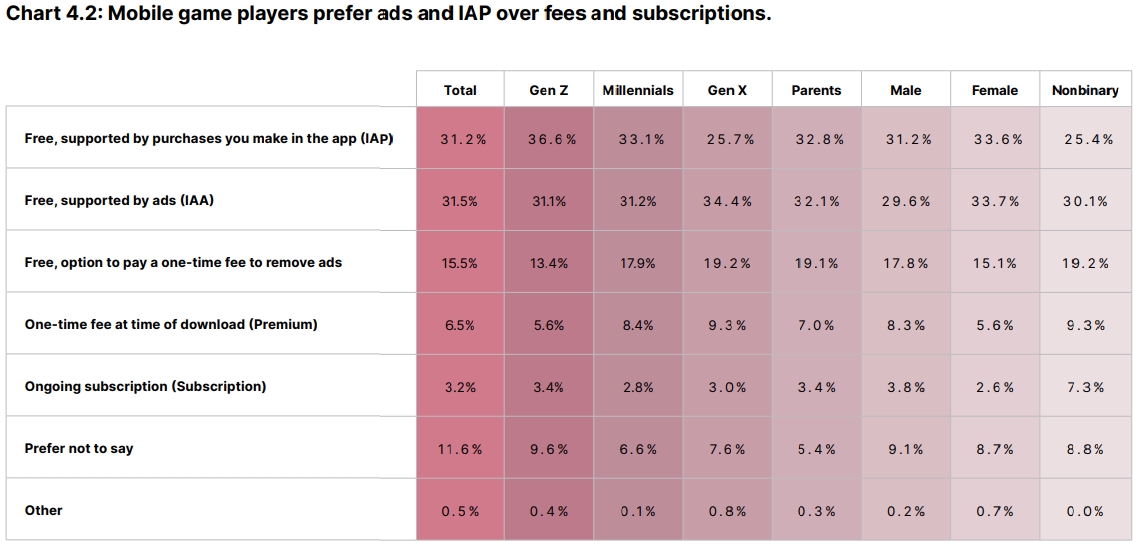

- According to Unity, the number of daily active users (DAUs) increased by 8% year-over-year for the median mobile game, but the rate of paying active users decreased by 2% from 2021.

- “This data suggests that more people are playing mobile games and they may be more willing and able to watch an ad rather than make a purchase,” the company noted.

- 31.2% of mobile gamers prefer IAP as the best monetization method. Almost the same percentage , 31.5%, prefer ads.

- The least favorite monetization tools among players are one-time fees (6.5%) and subscriptions (3.2%).

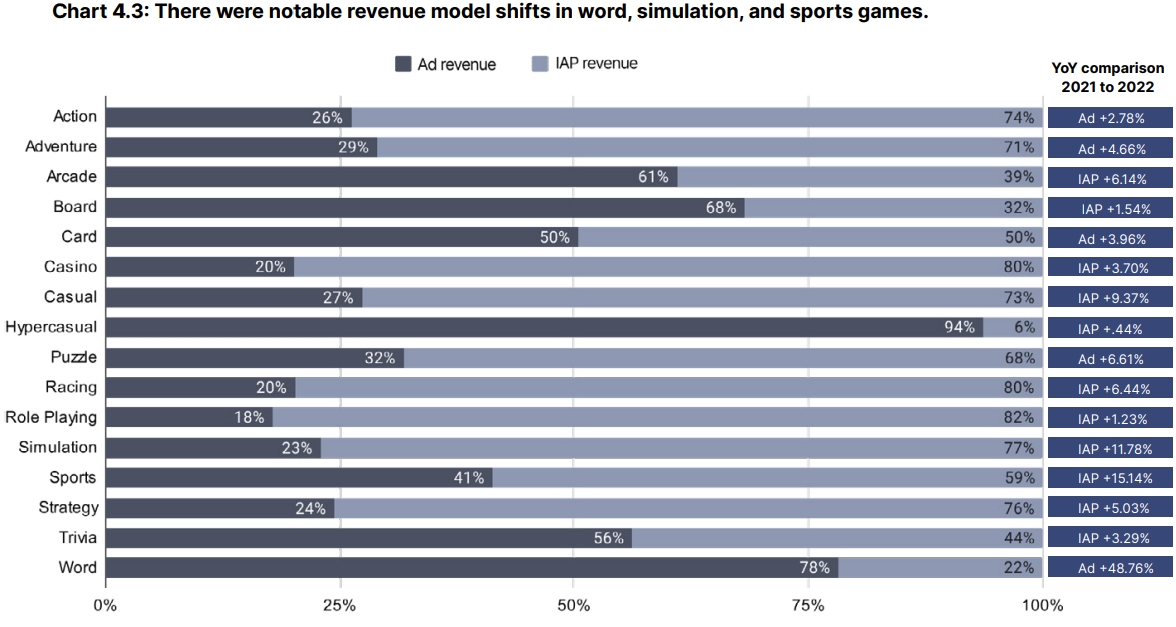

- In 2022, multiple genres saw some revenue model shifts. Sports and Simulation categories saw the biggest year-over-year growth in the number of games with IAP, at 15.14% and 11.78% respectively.

- Word titles experienced the biggest shift towards ad revenue at 48.7%.

More devs are leaning towards the GaaS model

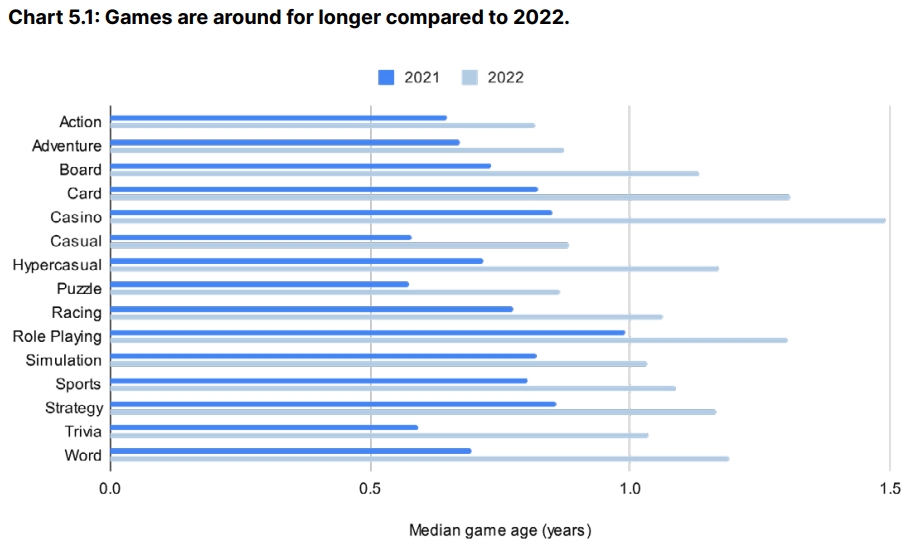

- In 2022, the lifespan of existing games was extended by 33%. The vast majority of studios with 50+ people update their titles for more than six months, but only 55% of indie teams support their games for that long.

- When it comes to post-launch support, 54% of indie developers name user acquisition as their biggest challenge. And 49% of midsize studios find retention challenging.

- According to Unity, games with more frequent updates have better D30 and D90 retention.

- Achievements and challenges remain the most common ways to keep players engaged. It is worth noting that studios with 50+ people use other techniques such as timed events (66%), daily rewards (65%), and social features (54%).

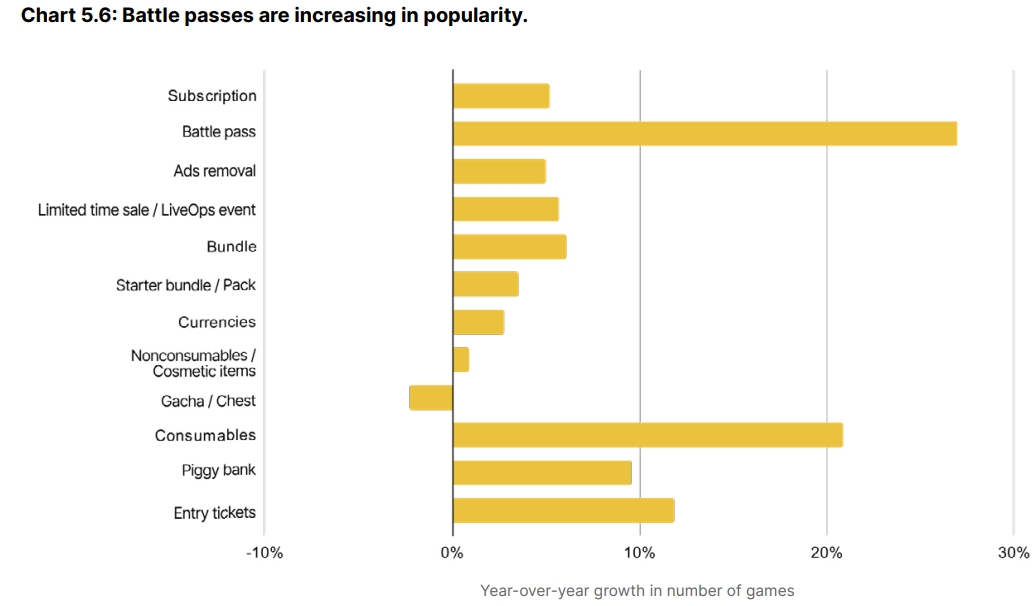

- In 2022, the number of games offering battle passes increased by 27% year-over-year. Consumables and entry tickets also saw double-digit growth, while gacha mechanics declined in popularity compared to 2021.

More information, including data on VR/AR games and insights from dozens of game developers and executives, can be found in the full 2023 Unity Gaming Report.