What does the gaming market in Africa look like

Not much is known about the African video game market. The Games Industry Africa (GIA) portal decided to fix this and published an analysis of the situation in the region. It contains data on the turnover of markets in different countries, the number of players and a couple of key trends.

The main thing from the material

- According to Newzoo and Carry1st, the number of gamers is growing rapidly in the so-called Black Africa (in 46 sub-Saharan countries). Over the past six years, their number has more than doubled — from 77 million to 186 million people. Analysts predict that over time this region can become one of the fastest growing in the world.

- This growth is due to the spread of digital technologies. More and more people in Africa are getting stable access to the Internet. Although, as GIA notes, now only two African countries support 5G — in Kenya and South Africa. Not without the impact of the COVID-19 pandemic.

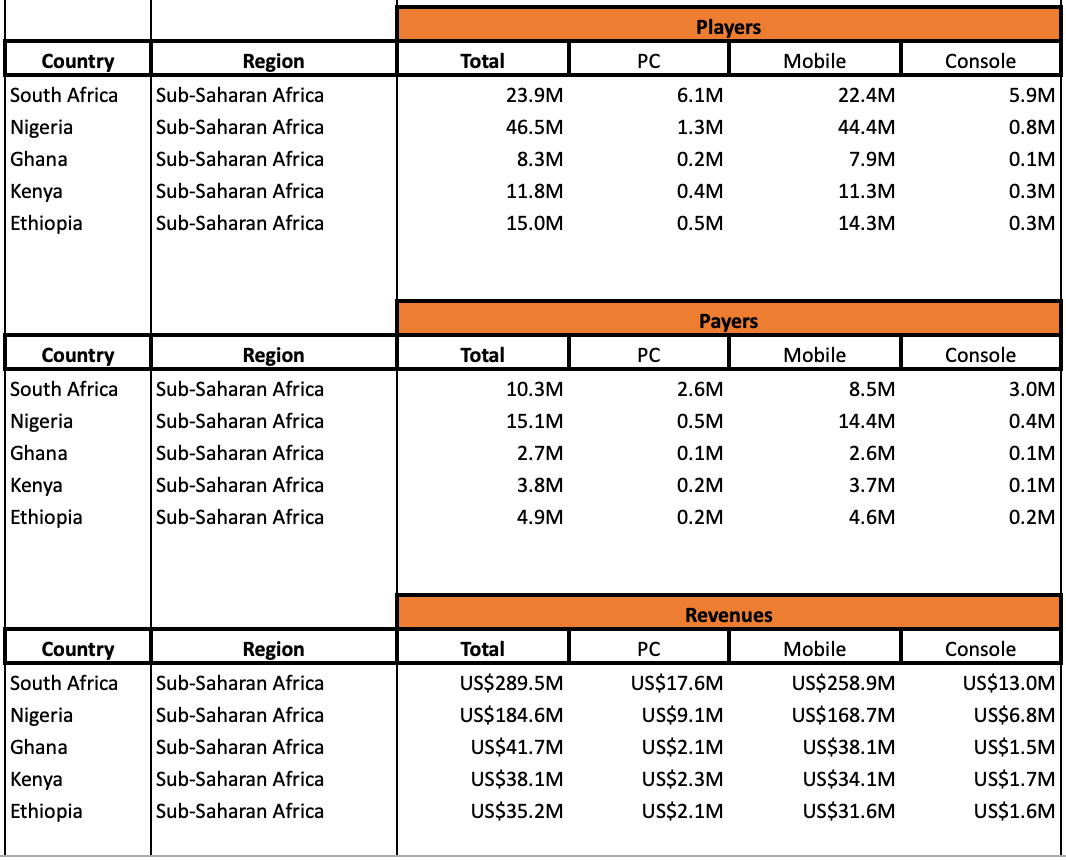

- Most gamers from Black Africa live in Nigeria — 46.5 million people (22% of the country’s population). The second place for South Africa is 23.9 million people (40%). Ethiopia closes the top three — 15 million people (13%).

- If we talk exclusively about paying users, then the first three places in the top went to the same countries. There are 15.1 million paying players in Nigeria, 10.3 million in South Africa, and 4.9 million in Ethiopia.

- Mobile is the largest platform in Black Africa by audience size. According to Newzoo estimates, 95% of all gamers in the region play on smartphones.

- GIA does not name the turnover of the entire African market, but gives it for the markets of individual countries. In South Africa, the turnover of the gaming market for 2021 amounted to $289.5 million, in Nigeria — $184.6 million, in Ghana — $41.7 million, in Kenya — $38.1 million, and in Ethiopia — $35.2 million.

- The lion’s share of user spending in these countries fell on mobile titles. PC games were the second largest in terms of spending.

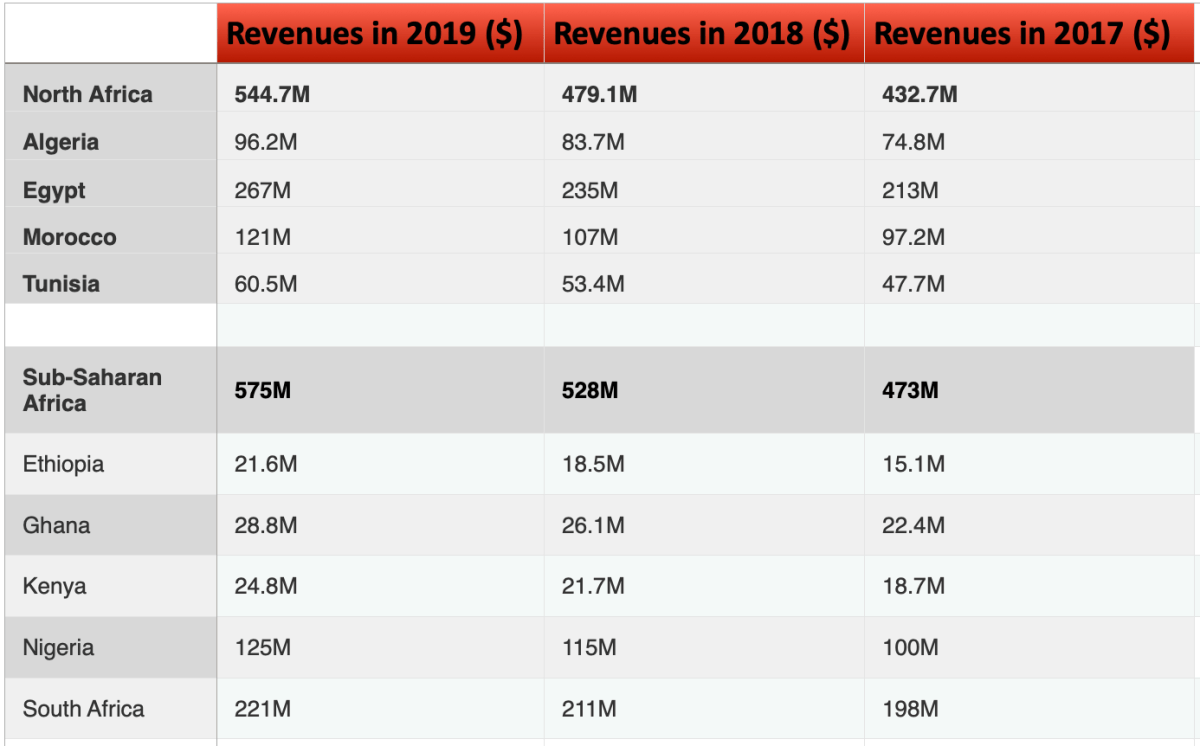

- As for the countries of North Africa, in 2019, the turnover of the gaming market in Egypt amounted to $ 267 million, in Morocco — $121 million, in Algeria — $96.2 million and in Tunisia — $60.5 million. There is no data on how income was distributed across platforms.

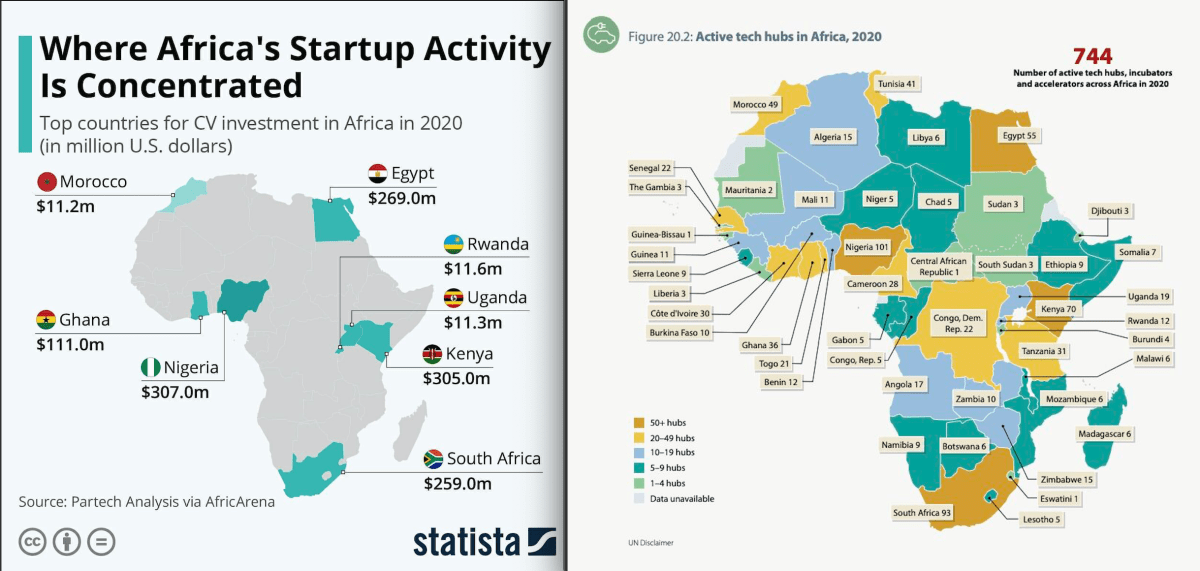

- GIA also indicated how much money from investors attracted African gaming companies in different countries in 2020 (according to Statista). Companies from Nigeria received the most funds — $307 million. They were followed by developers from Kenya ($305 million), Egypt ($269 million), South Africa ($259 million) and Ghana ($111 million).

- GIA considers the continued growth of investments to be one of the main trends of 2022 for Africa. In 2021, at least two funds of interest to African companies were opened: the African Game Developer Prototype Fund and the Diverse Game Developer Fund. The Black Game Developer Fund also cooperates with local startups. According to journalists’ estimates, more such funds should appear this year.

- The influx of investments may lead to the launch of new development studios. GIA also suggests that local studios will work together more often on games. Some companies are already using this practice. For example, in early January, the mobile game Mama Atingi Shop was released in early access — it was developed by four studios from four different countries.

GIA is going to regularly publish detailed reviews of the gaming markets of individual African countries. The first report on South Africa was released today. You can read it here.