SuperData summed up the results of 2018. The industry earned a figure of $119.6 billion

This is 13% more than a year earlier.

SuperData in its report divides the gaming industry into three segments:

- digital games — $109.8 billion;

- gaming video content — $5.2 billion;

- virtual, augmented and mixed reality — $6.6 billion.

Let’s focus on each of them.

Digital Games

Dynamics

The main and most profitable segment. In 2018, it grew by 11%.

Revenue of digital games by segment for 2018

The main drivers of growth were:

- an increase in sales of mobile games in Asia by $ 6.2 billion, which happened due to the growing interest of local players in hardcore titles;

- an increase in sales of console frituplay in the USA and Europe by 458% (or $ 1.4 billion in money) due to the popularity of Fortnite and the success of its monetization model – combat passes;

- increased sales of premium console games in the US and Europe by $1.3 billion thanks to excellent sales of PlayerUnknown’s Battlegrounds, the FIFA series and the Call of Duty series.

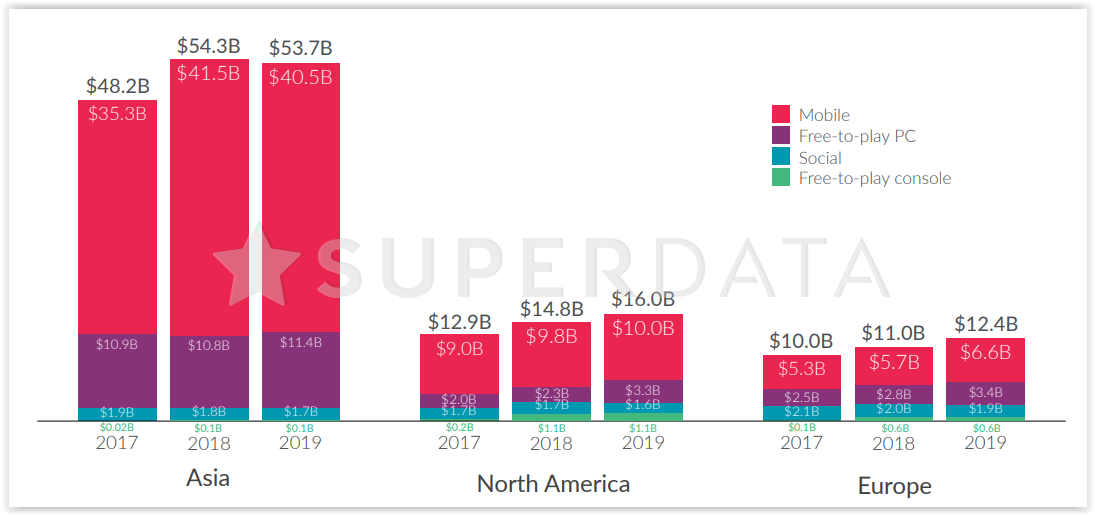

Fritupley

Free-play games ($87.7 billion) account for 80% of all gaming revenue in figure. Mobile plays the main role here ($57 billion). Mobile games earn the main cash in Asia ($41.5 billion). So it’s quite understandable why seven of the top 10 mobile games are developed by Chinese or Japanese companies. And in the coming year, it is unlikely that the situation will change in any way.

Revenue of free-play games by region (2017-2019)The highest-grossing freeplay game of 2018 was Fortnite.

The game earned $2.4 billion. This is one and a half times more than the game collected, which is located in second place in the top. One of the criteria for the financial success of Fortnite is the appearance of the game on all gaming platforms, as well as the successful development and use of previously little—used monetization — battle passes.

Top 10 highest-grossing freeplay games of 2018 Premium Games

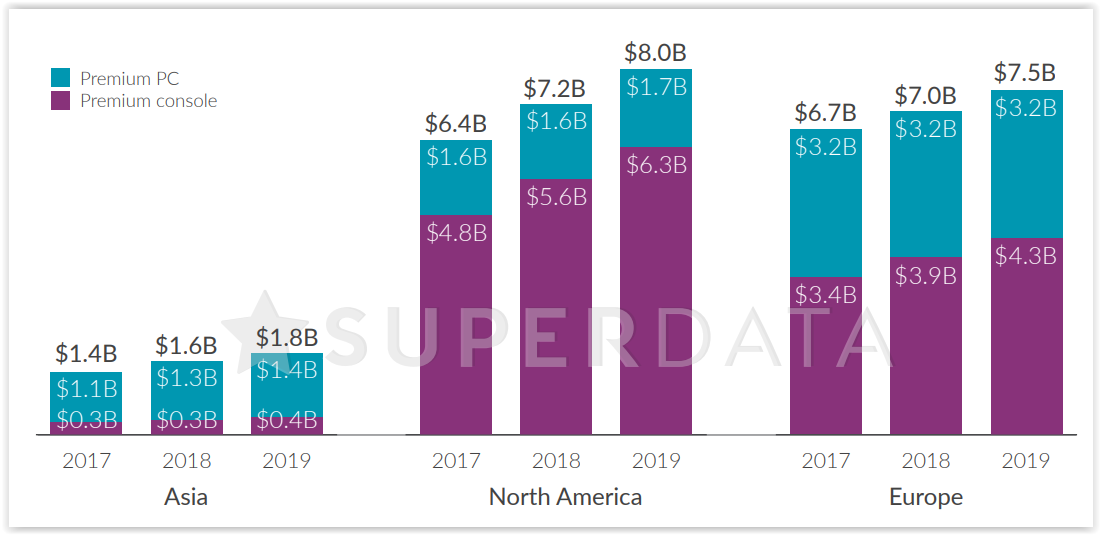

The share of sales of premium games relative to the fried is small.

The annual volume of the segment is $17.8 billion (in fact, it is difficult to say exactly how much, SuperData names three different figures in its report, we leave it to the conscience of the analysts who compiled the report). Moreover, the USA and Europe generate sums of the same order. The revenue of premium games from both markets last year amounted to around $7 billion.

Premium games revenue by region (2017-2019)The only paid game that earned more than a billion dollars last year was PlayerUnknown’s Battlegrounds.

Despite the fact that the game lost in the confrontation with Fortnite, its revenue for 2018 increased by 19%.

The presence of the “battle royale” mode in Call of Duty: Black Ops 4 in SuperData is considered the reason for the success of the game on PC. Despite the fact that the console version of the game in its debut year reached the same audience as the previous part of the game, the PC audience of the novelty turned out to be twice as large as that of Call of Duty: WWII at the end of 2017.

Top 10 highest-grossing premium games of 2018 Game video content

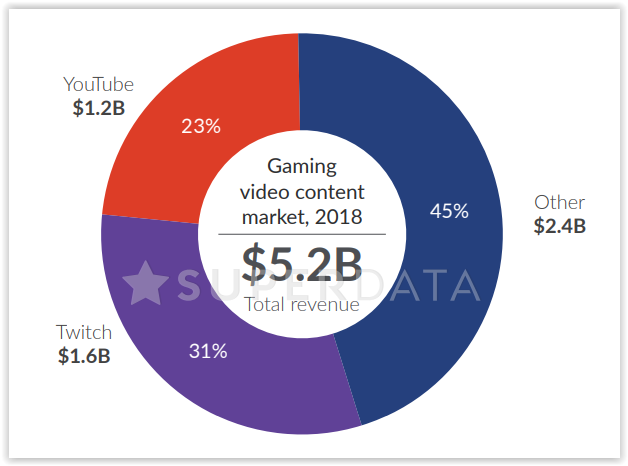

The audience of viewers who prefer to watch video content related to games reached 850 million people in 2018. This is 10% more than a year earlier. At the same time, the turnover is still difficult to call significant — $ 5.2 billion.

Analysts do not note how much of the specified amount falls on advertising. They don’t mention it at all as a monetization channel. However, they specify that donations (“donations”) and subscriptions are responsible for 32% of revenue on Twitch and only 9% on YouTube.

Out of curiosity: SuperData believes that Twitch and YouTube account for only 54% of the revenue of gaming video content. It is not specified on what other sites streamers earn.

The gaming video content market for 2018Virtual, Augmented and Mixed Reality (XR)

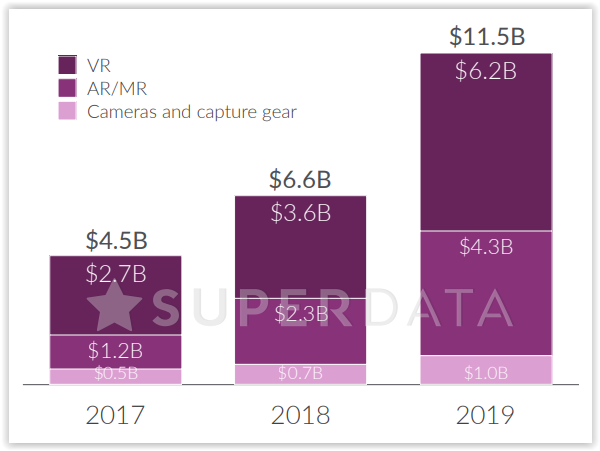

The XR market reached $6.6 billion in 2018. This is 46% more than a year earlier. Here SuperData took into account, among other things, the sale of devices (virtual reality glasses, as well as cameras and motion capture sensors).

Dynamics of the XR marketThere are three main growth drivers:

- Oculus Go sales — since its release in May 2018, 1 million similar devices have been sold;

- an increase in the market of local VR entertainment (entertainment outlets in places with high traffic, such as shopping malls) by 37%;

- the use of AR technologies in non-gaming applications (social networks, etc.).

The full version of the report can be viewed here.

Also on the topic: 6 facts about the video game market for 2017 from SuperData