How Zynga is Rebuilding its Portfolio for Further Growth

Translation of the article by Sensor Tower Analyst Anthony Bartolacci talks about how the recent purchases of the American publisher Zynga have rebuilt the company’s portfolio and opened up new growth prospects.

Anthony Bartolacci

Last week, Zynga announced the purchase of Gram Games studio (developers 1010!, Merge Dragons!, Six!) for $250 million.

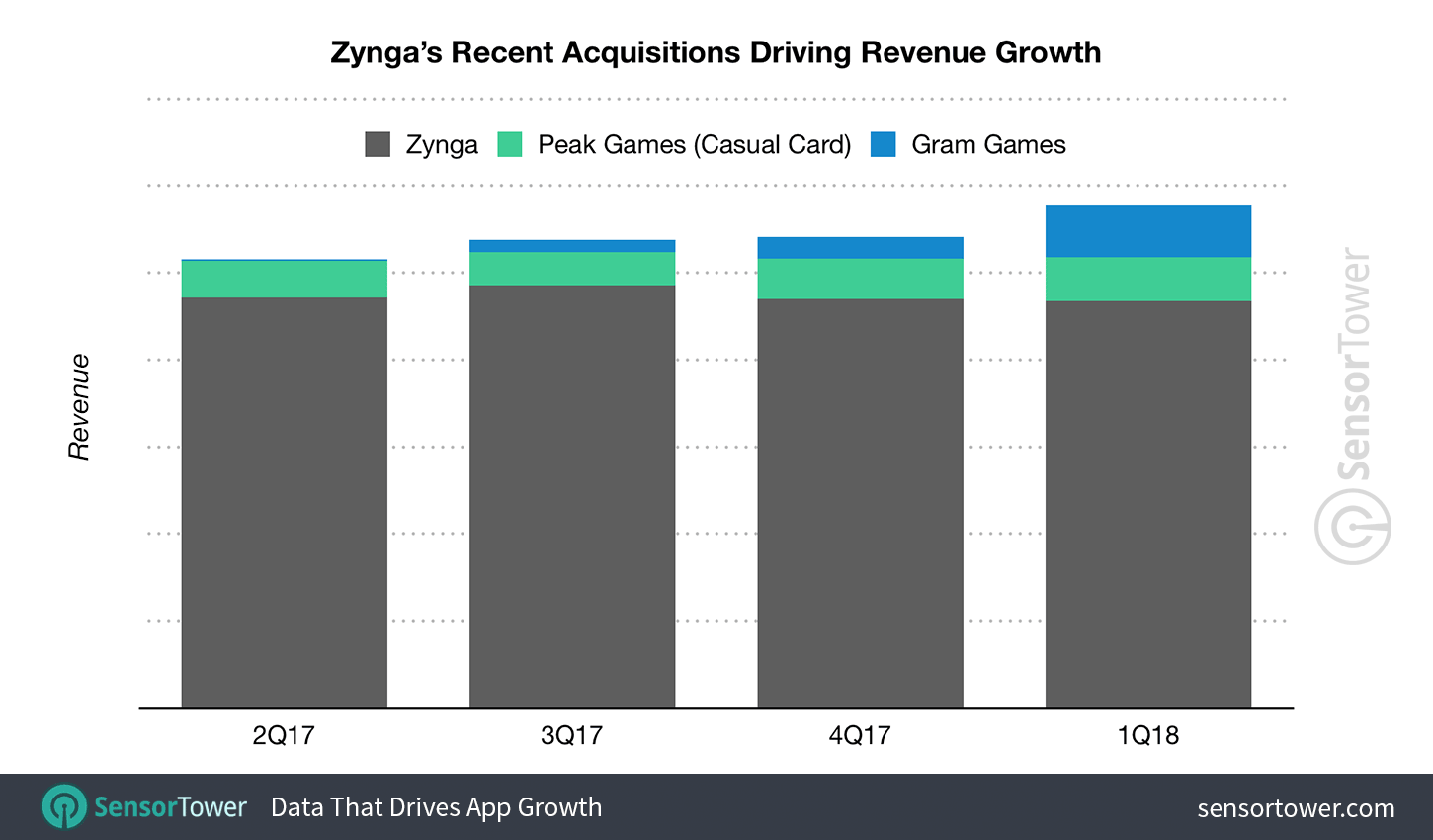

This is Zynga’s second significant deal in the last eight months – in November 2017, the company acquired the mobile card games division of Peak Games for $100 million. With these two deals, Zynga radically changed its portfolio.

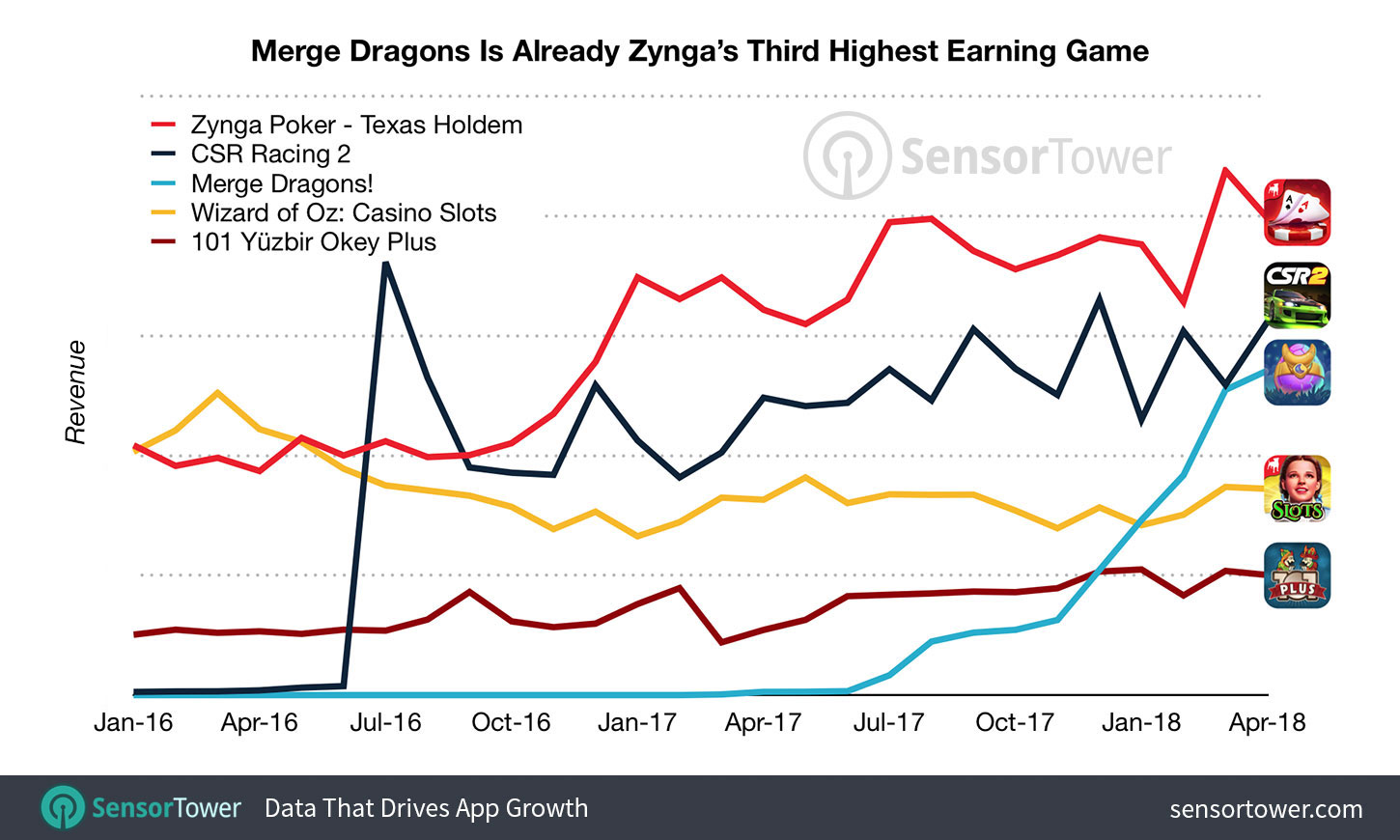

According to our estimate, Peak Games and Gram Games titles account for 23% of all Zynga earnings in the current quarter, and Merge Dragons! closes the top three highest-grossing games of the company, which also includes Zynga Poker and CSR Racing 2.

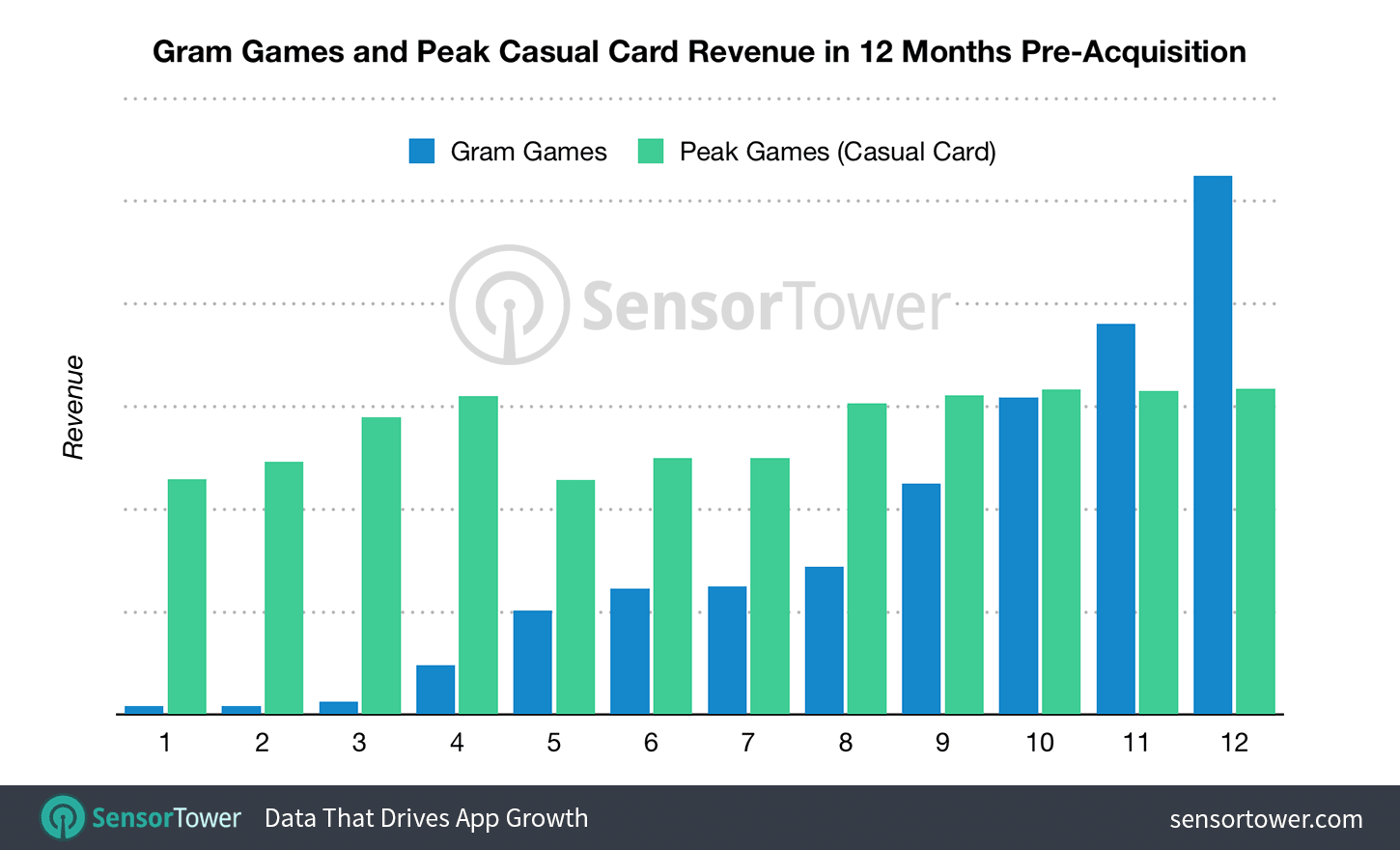

A few months before the Peak Games deal, we estimated the revenue from their card casuals at $4.4 million per month. Compared to last year, revenue increased by 40%, but the indicators from month to month remained approximately at the same level. Assuming sales remain stable, the $100 million price tag is about 1.9 times the annual revenue from these games.

Gram Games earned about $8 million a month before the sale, which means the transaction price amounted to 2.6 of the company’s annual revenue, again subject to stable demand for games. However, it should be taken into account that Gram Games took up monetization through mobile app stores less than a year ago [approx. — apparently, we are talking about the fact that the company has recently become monetized through in-game payments, and before that its projects were monetized through advertising ]. In the last three months alone, her income has grown by an average of 23% per month.

]. In the last three months alone, her income has grown by an average of 23% per month.

We also did not include Gram’s advertising revenue from their popular titles, such as 1010! and Six!, in our analysis.

DRAGON DANCE

According to our calculations, Gram Games received 97% of their revenue in online stores from Merge Dragons alone!.

In April, the game ranked 57th in the US in terms of revenue with the App Store and Google Play. In addition, it has become an international hit — half of the revenue from Merge Dragons! it came from outside the States. Let’s repeat: despite the fact that the game was launched only in June 2017, Merge Dragons! already in the top three highest-grossing applications in the Zynga portfolio.

DON’T DISCOUNT DOWNLOADS

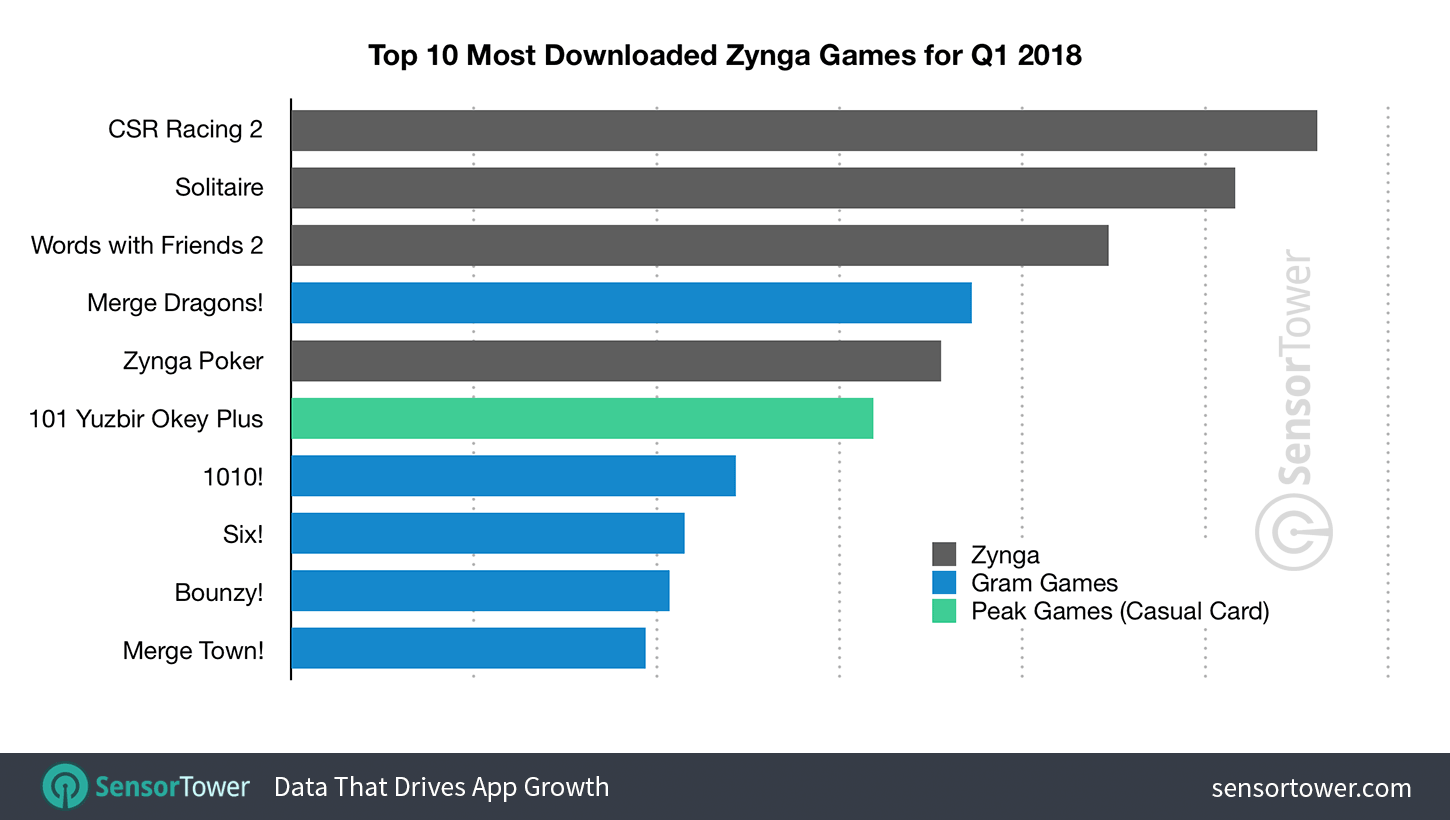

In addition to the success of Merge Dragons!, four more Gram Games would have been in the top 10 most downloaded Zynga games in the first quarter of 2018. Some of these apps are monetized through advertising, but Zynga may find other ways to capitalize on their popularity.

Another good illustration of how significant the company’s recent deals are: in the same first quarter of this year, Solitaire, purchased from Harpan LLC in March 2017, took second place in downloads of Zynga games, and 101 YüzBir Okey Plus, obtained from the Peak Games deal, took sixth place.

HOW THE ZYNGA PORTFOLIO HAS BEEN REBUILT

With its purchases, Zynga hit the bull’s-eye. The growth of the company’s previous hits has slowed down significantly recently. At the same time, the indicators of card games from the Peak Games portfolio are growing noticeably from quarter to quarter, and Gram Games’ quarterly revenue has grown by 150% at all.

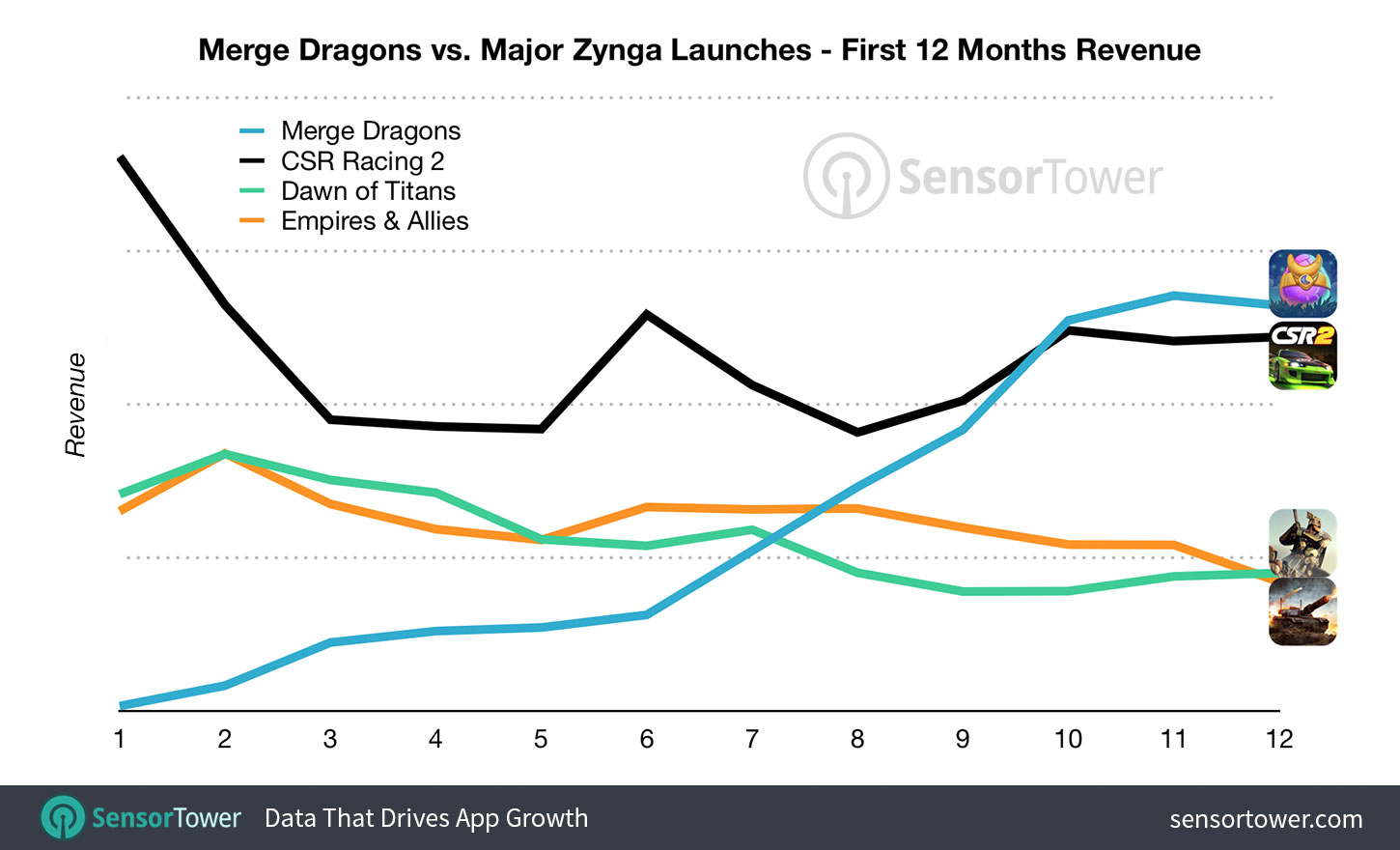

But perhaps the most encouraging factor for Zynga is that consistent monthly revenue growth from Merge Dragons! it has not stopped for a year since its launch. There are all prerequisites for the fact that this game will become an unfading hit on a par with Zynga Poker and  Wizard of Oz.

Wizard of Oz.

We believe that even faster growth rates of the title are possible, taking into account the influence and competence of Zynga in terms of supporting its games.

Also on the topic: