How was the 1st quarter of 2020 for the game development business sector against the background of the pandemic: report

How much has been invested in gaming companies? Which countries accounted for the bulk of the transactions? Has the coronavirus greatly affected the plans of gaming companies to expand their investment portfolio? About this and much more — in the financial report on the market for the first quarter of 2020.

The material was prepared by Sergey Evdokimov, investment analyst at MRGV and author of the telegram channel Gaming – M&As and Investments. The original in English can be found here. We offer the Russian version of the material.

Sergey Evdokimov

The main thing

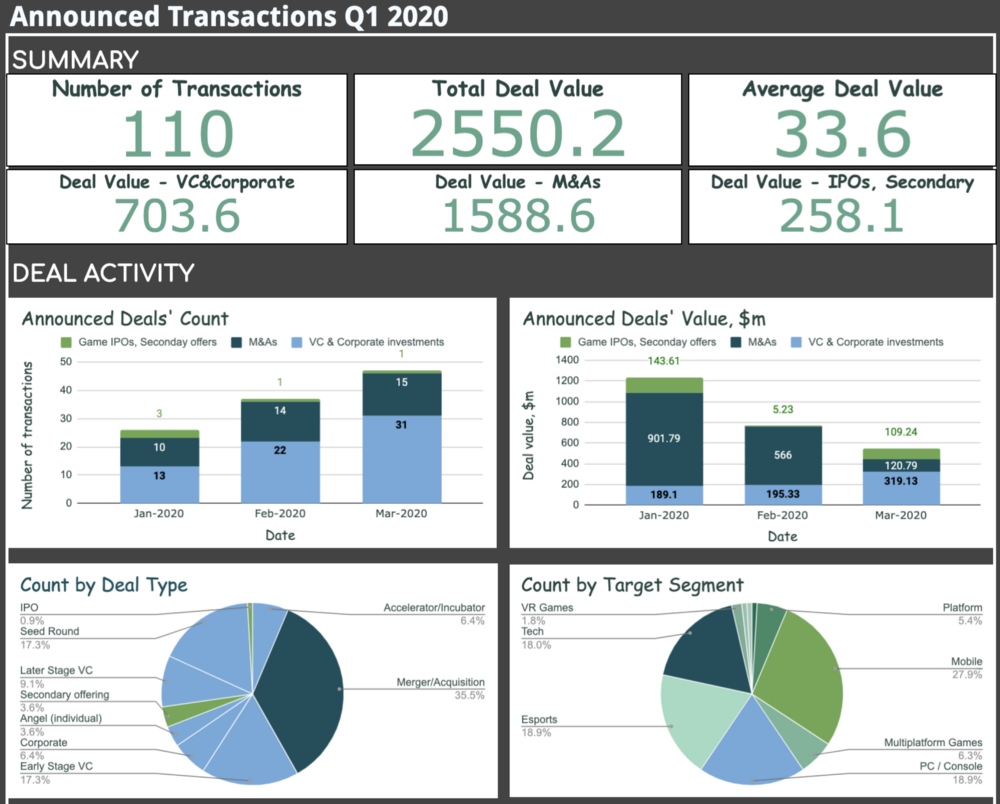

- In the first quarter of 2020, $700 million was invested in gaming companies. This is 63% less than a year earlier for the same period (the average value for the first half of 2019 was taken).

- More than 65% of the total amount of attracted financing came from the United States.

- The acquisition market, on the contrary, has grown. During the quarter, gaming companies (or shares in them) were acquired in the amount of $1.6 billion.

- The gaming IPO market almost froze in the first quarter. Only one company associated with game development entered the stock market during the reporting period.

- Most likely, venture capital activity will decrease over the next 3-6 months.

- 2020 may be the peak year in terms of the number of M&A transactions relative to the previous two years.

- Over the past decade, the gaming segment of the stock market for the first time will face a violation of cyclicity. Perhaps he will show one of the worst results since 2010.

Disclaimer: The data is based only on disclosed transactions, so we recommend focusing on relative values.

Summary of disclosed transactions (mergers, acquisitions, public offerings and fundraising campaigns) for the first quarter of 2020 (data can be downloaded from the link)

Current market situation

The situation on the investment market in gaming companies

2019 was a record year in terms of gaming investments. In twelve months, $7.2 billion was invested in gaming businesses. Of this amount, $3.8 billion fell in the first half of the year ($1.9 billion per quarter).

The first quarter of 2020 turned out to be much weaker in terms of investment. In total, $0.7 billion was invested in the games over three months. This is 2.7 times less than in the same period a year earlier.

The biggest rounds came on two California unicorns:

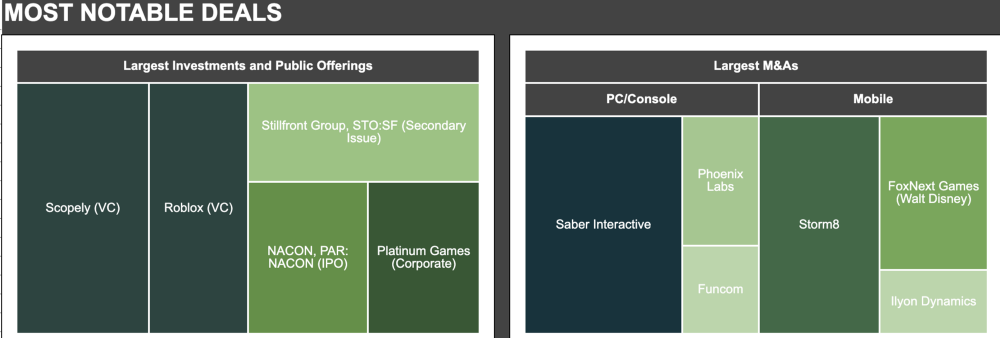

- After buying FoxNext from Disney for $250 million, developer and publisher Scopely raised $200 million from outside investors. This transaction took place within the framework of Series D, which in the final reached $ 400 million, based on the valuation of the entire company at $ 1.9 billion.

- The online gaming platform Roblox has attracted $150 million in Series G. The lead investor in the transaction was the Andreessen Horowitz Fund, which specializes in investing at late stages. The entire company was valued at $4 billion as a result of the transaction.

In general, the bulk of gaming venture capital turned out to be concentrated in the United States. 20 transactions (about $428 million of the total volume of $ 704 million) occurred in California, another 10 transactions (about another $40 million) — in other states of America.

Note that the deal to buy FoxNext Games is estimated at $ 250 million

The situation on the market of gaming mergers and acquisitions

The volume of mergers and acquisitions increased significantly in the first quarter. M&A transactions in the first three months of the year were made in the amount of $1.6 billion. For comparison, this is $600 million more than in the entire first half of 2019.

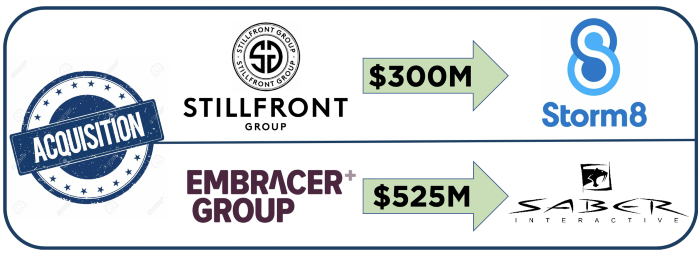

The largest acquisitions were made by Swedish video game holdings:

- Stillfront Group AB acquired Storm8, a California-based mobile game development studio, for $300 million. An additional $100 million can be paid to the owners if the company’s EBIT reaches its targets in 2020 and 2021.

- Embracer Group AB (formerly THQ Nordic AB) has bought Saber Interactive, a console game developer headquartered in the USA. The transaction amount is $150 million. Another $375 million will be paid if the company fulfills a number of requirements. By the way, Embracer Group AB is a very active buyer. Over the past 12 months, the company has completed more than eight transactions.

The situation on the gaming IPO market

For ten years now, the gaming IPO market has been cyclical. One “strong” year was followed by two “weak” ones (in terms of the volume of attracted financing by placing shares on the stock exchange). The last record year was 2017. It was followed by 2018 and 2019, which can be described as “quiet”.

It was assumed that 2020 would show growth in terms of funds raised and the number of exits. However, this may not happen if the same trend that was observed in the first quarter continues.

The fact is that in January-March, only one company related to video games entered the stock market — NACON. Previously, it was a division of the gaming BigBen Interactive. Now NACON is engaged in the production of gaming accessories, as well as the development and publication of games.

During the initial public offering, which took place on March 4, the company raised $109 million.

If we talk about the stock market, it is worth noting the friendly takeover of the Oslo-based studio Funcom by Tencent. A Chinese company has bought 67.55% of a Swedish public company traded on the Osaka (OSE: FUNCOM) stock exchange. The deal was approved on March 25.

***

If we consider the investment market in the gaming sector as a combination of venture and intra-industrial transactions, it did not show a drop in the first quarter against the background of the pandemic. Such market activity, occurring despite the decline of the entire global economy, is explained by the fact that transactions are closed for a long time. Simply put, many of the deals announced in March were discussed and executed long before the recession.

Forecasts

Forecast for venture deals

In the coming months, we should expect a drop in the number of venture deals. Most likely, the funds will focus on supporting companies from their investment portfolio. This is due to the following factors:

- macroeconomic instability caused by high oil price volatility and sudden increase in unemployment due to the spread of coronavirus;

- reducing the number of face-to-face meetings, which complicates the search for partners and the process of agreeing deals;

- delays in company registrations and transaction approvals by government regulators;

- difficulties in conducting a comprehensive legal and commercial audit that affect the quality of transactions.

Forecast for strategic transactions

Strategic investors, whose financial position has strengthened and who are now seeing an increase in game sales, may react to the situation differently. Perhaps they will increase their shares in promising gaming companies, whose value has decreased against the background of general instability.

However, do not expect an instant increase in activity at the level of corporate investment. The fact is that most of the gaming corporations will need time to:

- determining the consequences of falling and high volatility of securities quotations;

- assessment of possible delays in the production and release of new titles;

- debugging workflows in remote conditions;

- assessment of the changed behavior of the players.

Of course, some strategic investors will abandon deals and focus on the existing portfolio.

Stock Market activity forecast

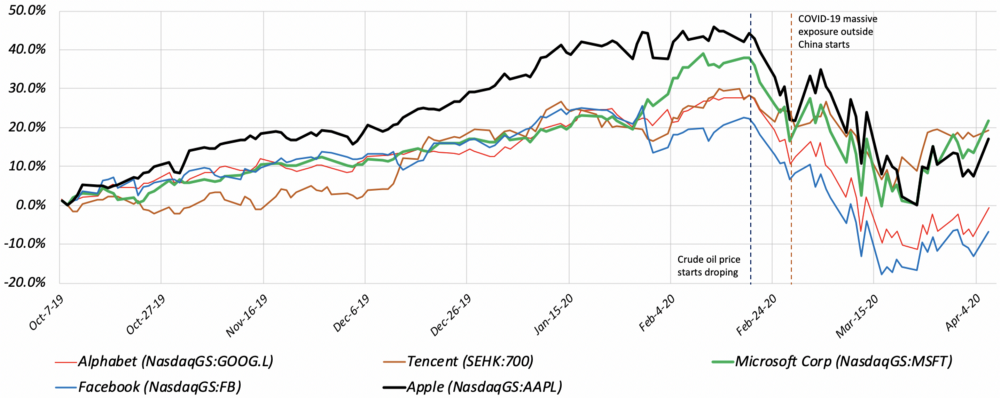

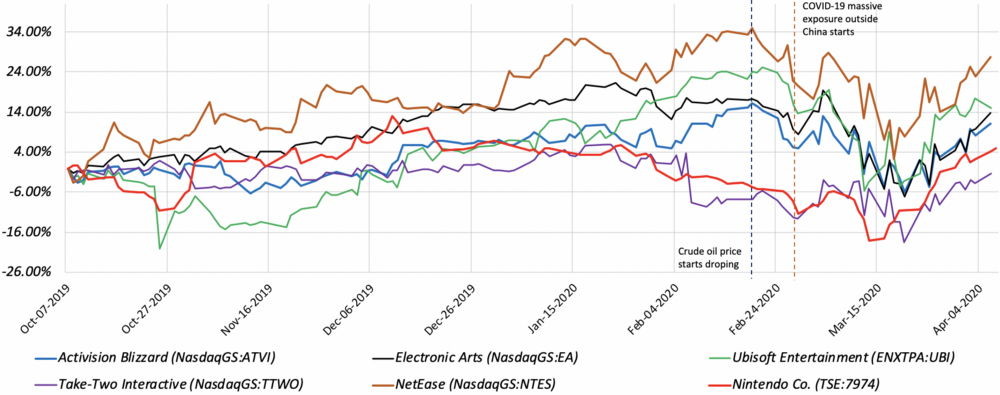

So, we should have expected an increase in activity in the gaming IPO market in 2020 … But, unfortunately, this did not happen: the stock market faced huge volatility. At the end of February, all entertainment gaming companies recorded a drop in the value of shares, followed by a small gradual increase (at least, it has been observed in recent weeks — March 20 — April 5).

The dynamics of the stock price of a large ecosystem strongly affects the gaming sector

Now the market is in limbo due to the fall in oil prices and the pandemic, which have rearranged the IPO schedule for the whole year. If the market stabilizes in the second quarter, many companies will decide to enter the stock market this fall. But in any case, this year is already a living nightmare for public companies, fearing that the macroeconomic downturn will alert many investors.

Dynamics of the share price of the largest video game publishers and developers

Is there a light at the end of the tunnel?

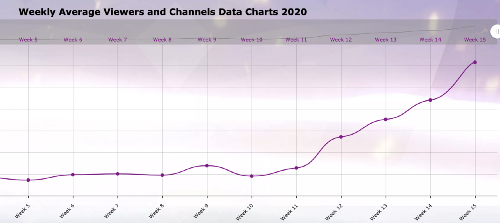

Firstly, we are seeing a significant increase in interest in video games due to an increase in their sales, the time spent in them, the growing popularity of streaming, and so on. The more people resort to self-isolation and get acquainted with the world of digital entertainment, the more players, including paying ones. Perhaps this will lead to a significant increase in the actively playing audience. In other words, we are not dealing with a short-term change in the situation, but with long-term consequences.

The consumption of game content, in general, is considered resistant to economic downturns. During economic recessions, players reduce secondary expenses, leaving only the most affordable and cheap entertainment. Given that video games are one of the cheapest forms of entertainment, game sales may increase in the medium and long term.

Secondly, M&A activity is likely to continue to grow. For example, Embracer Group recently raised $164 million by issuing additional shares on the stock exchange. According to the company, this money will be used for the further purchase of video game developers and publishers.

Startups in need of capital raising, as well as studios experiencing problems, may find themselves in the sights of companies interested in new assets or employees. Moreover, their relatively reduced price in the current conditions will be very attractive for potential investors.

Thirdly, the current venture capital industry is more stable and liquid than before. Now there are both non-core venture firms interested in investing in games and corporate venture funds ready to invest in gaming startups on the market. We are also observing the development of the secondary securities market.

Is there any news? Share it with us, write to press@app2top.ru